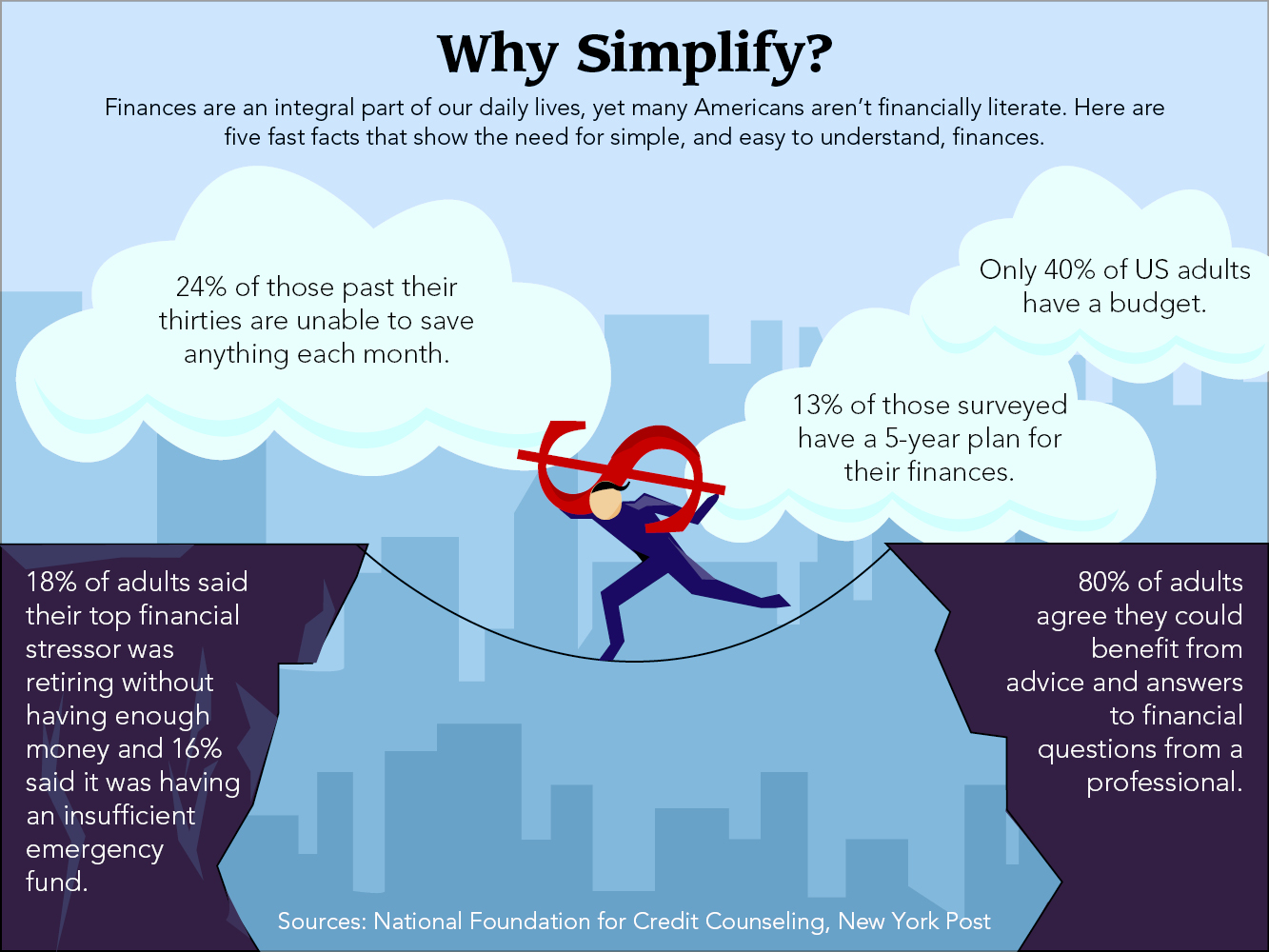

August is Simplify Your Life Month, and while we’re not experts on simplifying your closet or your cleaning routine (but actually, make your bed everyday), when it comes to finances, we’ve got you covered.

Let’s be real. Between chaotic families, and busy work schedules, none of us have time for a confusing financial life. Sometimes it really is best to go back to the basics in order to straighten everything out, so here are our top eight tips for simplifying your finances.

Go paperless for everything

It’s always a good idea to keep track of important financial records, and going paperless is a great way to do so without adding to your desk clutter. Let’s say you have just one checking and savings account, a phone bill, a cable/WiFi bill and a couple subscriptions to things like the local gym. Right there you’re looking at five to six different papers you have to track/file each month. Those add up fast! Minimize your chances of losing important papers, or forgetting to pay those bills, by signing up for E-Statements whenever possible. Most companies offer, and even encourage, their customers to use E-Statements.

Are you paperless at Central National Bank? If you’re still getting your statements in the mail, follow these steps to switch over to E-Statements today.

Automate your flow

In the name of never missing a bill or paying a late fee again, try to automate the process. Always use online bill paying services. Ensure that you have direct deposit set up for your paycheck. Link all your accounts properly. You can even set up your bills to auto-pay as they come in. If you choose to do this, don’t just “set it and forget it,” though. Make sure that you’re still looking at your monthly statements to catch any errors, hidden fees you’d rather cut or sudden changes in your service.

Find the big picture

It’s hard to simplify your finances if you’re worried about every little transaction. Instead, keep an eye on the big picture. Use an account aggregation program such as MoneyCentral to see where your money is going in one convenient location. This will make creating and sticking to a budget that much easier.

Consolidate everything

Consolidate your accounts. Do you have three different checking accounts and five savings accounts at four different financial institutions? Close down those extras and merge them all into a primary checking and savings account at one institution. You’ll have fewer accounts to manage and may be eligible for better rates or terms for having more business in one place. Then, take a look at your investment and retirement accounts. If you’ve worked at multiple companies, you’ve probably got multiple 401(k)’s. Roll those over into an IRA. With your retirement funds in one place, it’s easier to make changes, take out money during retirement, etc.

Filter out advice

Everywhere you turn someone has advice on how to manage your finances, and an awful lot of it conflicts with the advice someone else has. Pick just a few sources that you trust (ahem… CNBConnect anyone?) Follow them (us) on social media, read their (our) blog, etc. and find a system that works for you. Then, tune out the rest of the noise.

If you’re not sure where to turn for advice, explore various blogs to figure out who you align with. For someone with a very minimalistic approach, try Cait Flanders’s blog and/or book about “The Year of Less,” where she cut out all unnecessary spending. For an emphasis on small, manageable steps, try Dave Ramsey’s blog, which covers a wide variety of topics. For a psychological focused approach on personal finance, look at Suze Orman’s blog.

Regardless of who you choose to follow, make sure you feel they are valuable to you and that they align with your financial goals.

Change your investment style

Unless you’re an expert, there’s a good chance you’re making investing more complicated than it needs to be. Taking the time to find, pick and research individual stocks can get very complicated and be seriously time consuming. Instead, consider investing in funds. When tax season comes around, funds are much simpler to deal with when it’s time to file your return. This will save you time, and possibly money, if someone else is charging you for the cost of preparation.

Cut out the extras

Cut out all those extra and unnecessary services. That gym membership? Out. Unlimited data? Gone. Premium cable package? Not anymore. There are a lot of things you’re probably paying for that you don’t really need or use. If you like them and have the money to maintain them, that’s fine. But, if you’re stuck in a spending rut and need to simplify your finances, cutting these out will help. While you’re at it, take a look at your belongings and try to sell anything you don’t use or like anymore. It’ll simplify your life and bring in extra cash!

Narrow down your income sources

This isn’t to say quit your day job (definitely don’t do that), or get rid of your weekend side hustle. If you can make some extra cash as an Uber driver, then good for you! But if you have a full-time job, work as an Uber driver, list your possessions on Ebay and work as a direct seller for Monat, then you’re probably attempting too much. Doing one job well is probably cutting into your ability to do the other jobs, which is both decreasing your income and adding unnecessary stress to your life. Instead, stick to two of those. You’ll be able to devote more time to doing those jobs well and still bring in extra income.