Tax season is well underway, so if you haven’t already filed your return, now is the time to gather all your paperwork, track down your W-2 and get started. If the thought of wading through all those documents has you procrastinating, we’ve put together a brief overview of which ones you’ll need currently and which ones you can get rid of from past years. Hopefully this will help you feel better organized and ready to get your taxes filed!

What records do you need to file?

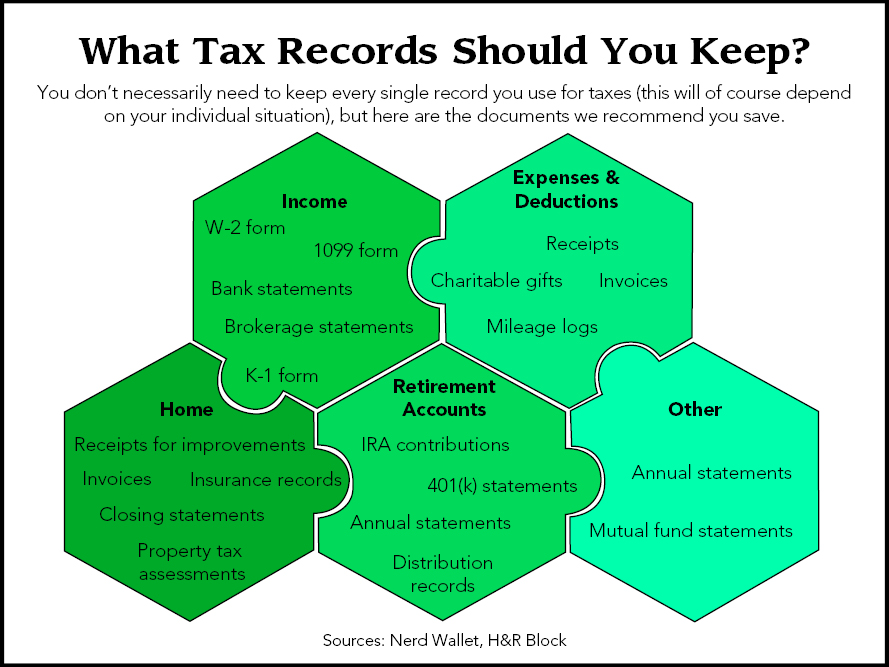

This is going to vary depending on your situation. In general, you’ll need to know:

- Personal information: such as your social security number

- Dependent information: such as a child’s social security number

- Documents for your sources of income

- Forms for deductions such as home ownership, educational expenses, charitable donations, etc.

For a more comprehensive list, check our H&R Block’s “What Do I Need to File My Taxes?” tax prep checklist.

How long should you keep your records?

It’s important to keep certain tax documents in case you’re ever audited by the IRS or you need to file an amended return. How long do you need to keep things on file? That depends on your situation.

If you report everything correctly, you should keep all your documents for three years because that’s how long the IRS has to audit you. However, if you under-report your income by more than 25 percent, you should keep everything for six years because that window doubles.

There are situations where you should keep your records indefinitely. For example, if you take a yearlong break from work and don’t earn enough income to file, you should keep proof of this. We’re assuming you’re not committing tax fraud, but someone who does would also need to keep all documents forever.

It’s also a good idea to keep a permanent record of your previous tax returns, even after you’ve gotten rid of other documents.

Please keep in mind that there are exceptions to every rule, and that your tax situation and needs are unique to you. For additional advice, consult with a tax or wealth management professional.