You likely already know that home insurance is extremely important to have as a homeowner, but do you know what your policy is actually covering? At Central National Bank, we find it important to not only supply our customers with products that best fit their needs, but to educate our customers on what it is they are doing with their finances and the belongings they hold most important. Making sure you understand your Insurance policy is no exception to this. There are multiple levels to a home insurance policy, so we’re here to break down the different coverages and help you to understand what you’re paying for as well as what is covered.

Why do I need home insurance?

Before we break down the parts of a policy, we’ll answer this simple question: Why do I need home insurance? Insurance is designed to cover the cost of repairing and replacing the structures or items under the policy. If your house were to be severely damaged, insurance would help repair or rebuild the structure. If you have personal items that were damaged in an incident, insurance can help you replace those losses as well. Homeowner’s insurance will also help to pay for medical bills if someone were to be injured on your property. It could also potentially cover legal fees if there was a lawsuit for an incident.

Aspects of a Homeowners Policy:

Coverage A

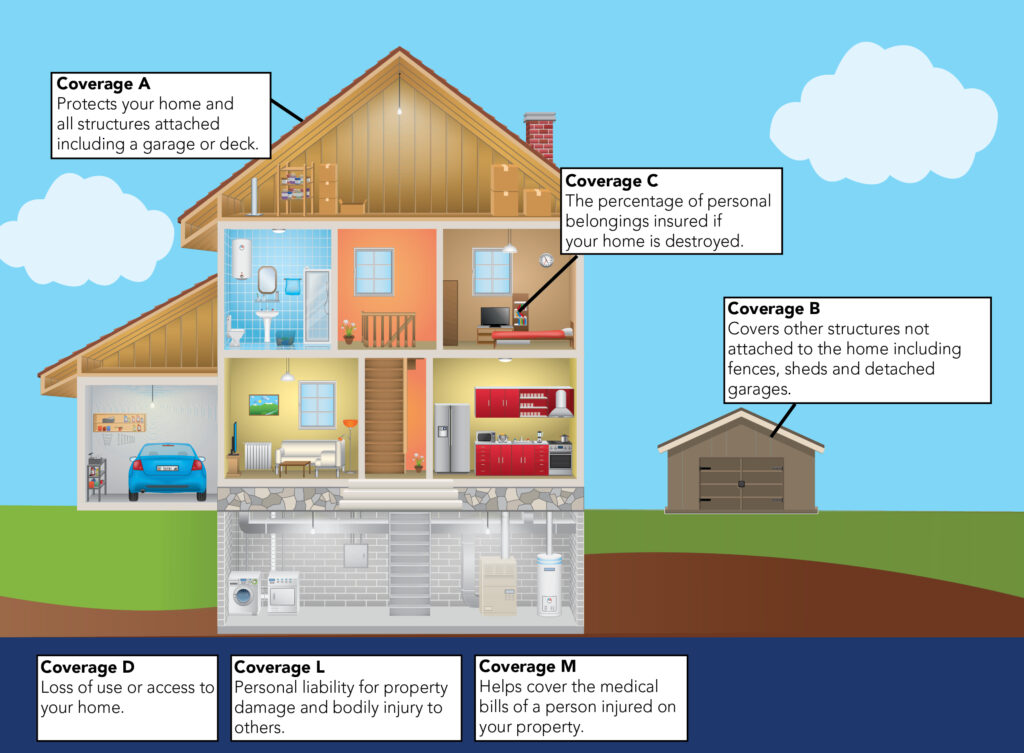

This is your standard coverage. Coverage A covers your home itself and any structure connected to the home. This includes garages and decks. This is the coverage that helps you rebuild your home if something were to happen requiring you to rebuild or repair a portion of your home.

Coverage B

Coverage B covers the other structures on your property. This includes fencing, sheds, shops or a detached garage. If you have any of these structures on your property, make sure to review your policy, confirming whether these structures are covered.

Coverage C

Coverage C is designed to cover a percentage of personal belongings if these items were to be lost when your home is destroyed. There are some limitations on what is covered. Consult with your agent for a full explanation of how this works. When you receive a copy of your policy, be sure to review it and ask questions about your coverages if you have any.

Coverage D

If your home is severely damaged, Coverage D comes into play. This coverage helps to pay the costs of relocation while your home is brought back to a livable state. Your agent can go into more detail, but this generally only works in situations where a storm, flood or fire has made it impossible to live in the home. Deciding to renovate, and running into issues along the way, is not necessarily going to be covered by your policy.

Coverage L

Coverage L and Coverage M are fairly similar.Some consider Coverage L to be one of the more important aspects of your coverage. Coverage L protects you if someone is injured on your property, or you cause damage to someone else’s property. This coverage excludes any damages done by you to your own property.

Coverage M

If someone is on your property and is injured in an accident, Coverage M will help pay for the medical bills of the injured person. This coverage is limited per accident and per person. Additionally, the payment is made regardless of legal liability.

You may, or may not, know but Central National Bank has an insurance department. Central Insurance Agency is an independent agency, meaning they can quote multiple insurance companies to help you get the best policy for your needs. Visit any Central National Bank location for information about Central Insurance Agency. You can also call 888-262-5456 to get your questions answered.

Update: Central National Bank no longer offers Insurance services from an in-house agency, but you still have access to an agent in many of our locations. We’d be happy to refer you to an agent who can provide assistance. Call your local branch and ask, today!