There are a lot of options when it comes to investing your money. For someone who’s not ready to jump into the stock market, but is looking for something beyond a traditional savings account, a certificate of deposit (CD) is a great choice. CDs are low-risk and carry a better rate of return than savings accounts.

How they work

There are multiple types of CDs, but in general, a CD is a timed deposit. This means once you put your money into the account, you agree to leave it there for a certain amount of time. It’s untouchable unless you’re willing to pay a penalty fee for early withdrawal. At the end of the agreed-upon term, you get your money back, plus interest. Here’s something to consider when opening a CD:

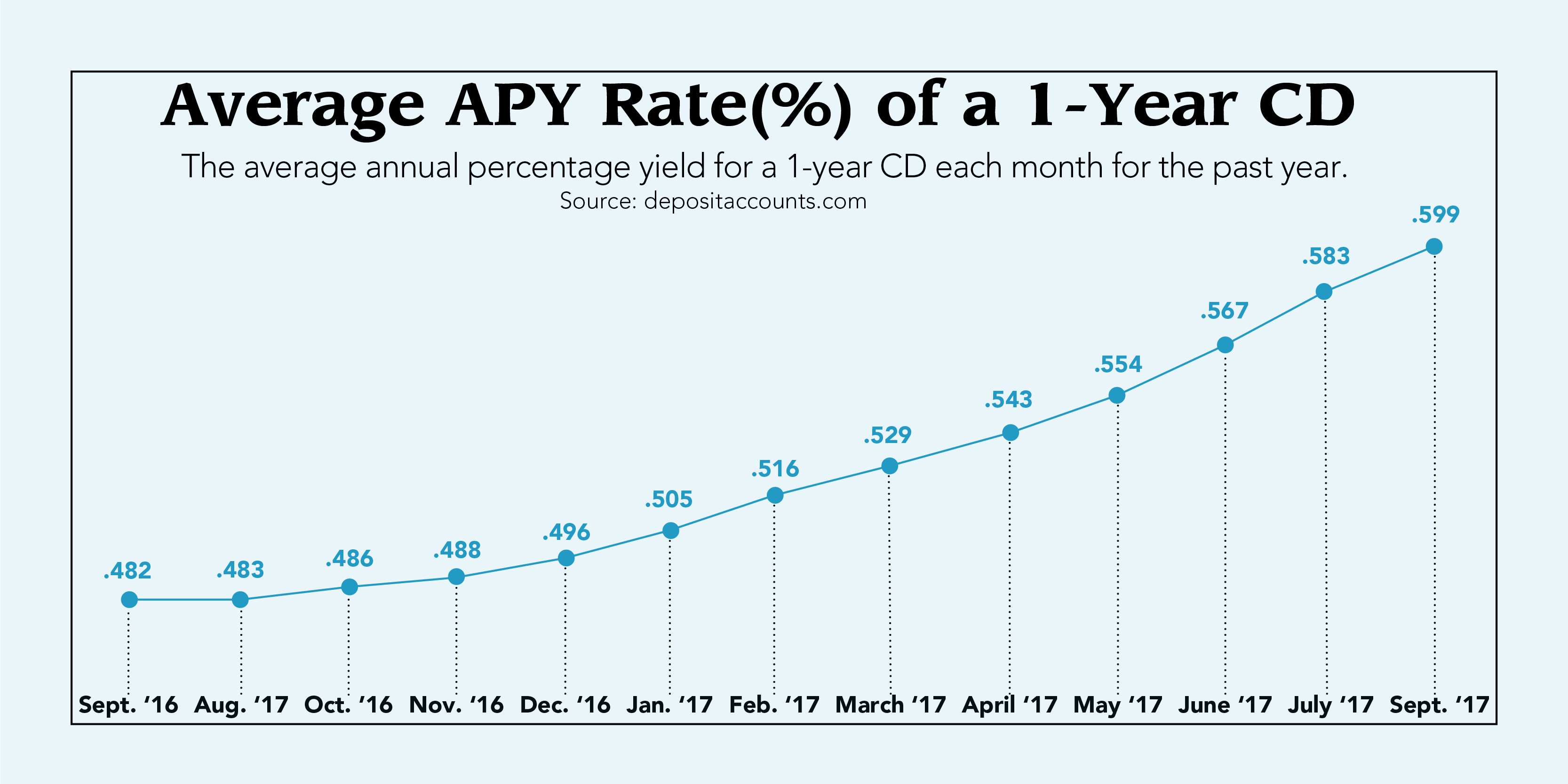

- What is the APY, or annual percentage yield? The APY is the rate of return you will get each year, taking into account the effect of compounding interest. The higher the APY, the more money you’ll get at the end of the term.

Advantages

Options: While you can’t withdraw your money during the agreed-upon term of your CD, there are plenty of choices when it comes to term lengths and even types of CDs.

Safety: CDs, along with our checking and savings accounts, are covered under FDIC insurance up to $250,000 per depositor, making them a safe and low-risk investment. For more information about FDIC insurance coverage visit the FDIC website at https://www.fdic.gov/deposit/deposits/

Low/No Fees: Typically, banks have a low (or no) monthly fee to keep your money in a CD there. This helps maximize your earnings.

Fixed Returns: This means the rate received at the beginning of the term will remain constant throughout the length of the CD, even if interest rates fall in the broader economy.

Disadvantages

Non-liquidity: For the duration of your CD’s term, this money is inaccessible without paying penalty fees, so make sure to plan ahead financially.

Did you know: One way to maintain some liquidity is to receive your interest throughout the term, by having the interest direct deposited into your checking or savings account.

Inflation risk: If your rate doesn’t keep up with the rate of inflation, you’re losing money in the long-run. To combat this, consider the length and type of CD you pick.

Fixed Returns: This one is also under disadvantages because your rate will remain constant throughout the CD term, even if interest rates rise in the broader economy.

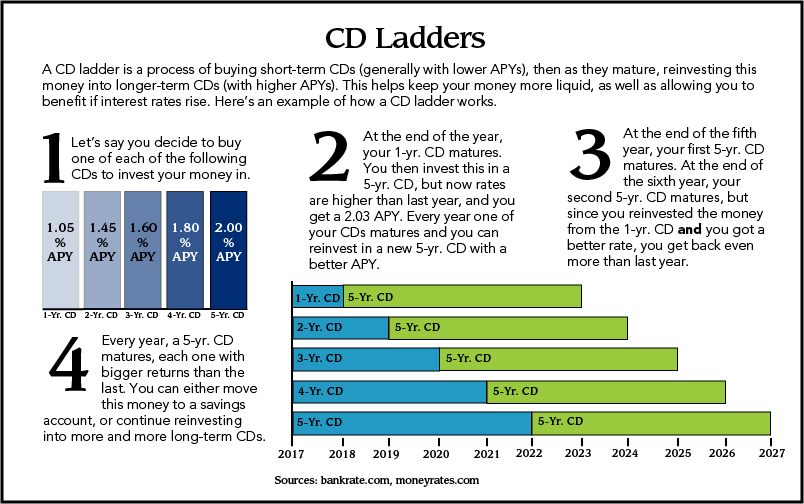

Want to know more about laddering and strategizing with your Certificates of Deposits? Check out our other blog posts.

Why not savings accounts?

Nothing is inherently wrong with a savings account. When rates are up, it’s important to carefully consider the savings options available to you and how you can earn interest. While CD’s are a very low-risk investment vehicle, it can be argued that savings accounts are nearly the same from a risk perspective, especially if you use a Money Market account to save.

Risk aside, what’s the difference?

A savings account generally has a lower rate of return than a CD that is flexible – meaning it can change from week to week along with the institutions rates. However, and this might be a positive for you, a savings account generally requires a lower minimum opening deposit.

You can make periodic withdrawals from a savings account, but you’re generally limited in the number of withdrawals you can make during each statement cycle, or month. Some institutions implement a fee if you go over a set limit. That shouldn’t be too much of a problem if you’re using it to save money – since more regular withdrawals might mean you’re spending money and not saving.

Savings accounts are great for short-term savings goals, like saving up for the next purchase. The cell phone upgrade you’ve been planning for in six months gets a little boost when rates are high, but you probably don’t want to tie that money up in a CD for a longer term.

You might be asking, “wait, didn’t you say something about a money market? What’s that?”

A money market account differs from a savings account in two ways. Generally, they require a larger minimum opening deposit amount and you must maintain a higher deposit balance. And the other way is that they typically allow for more transactions, in addition to more transaction types. For instance, you can order checks and also make bill payments from a money market account, but you cannot do that from a savings account.

Our Rates

To find out more information visit our website and learn more about CD’s or savings and money market accounts. Or, check out our rates.

Member FDIC

Thanks for helping me understand that CD accounts are time deposit accounts even if there are a lot of options for them. I heard that a friend of mine is interested in that kind of option for herself in order to have enough savings for her dream. From what I know, her dream is to have her own house whether she’s going to live on it on her own or she is going to have a family in the future.