Over the past decade or two, check usage has been on the decline. It is easier for us to carry a debit card than a book of checks. However, there are still instances where you may want to write a check. Since many readers may not have written a check recently, if ever, we’re providing this quick tutorial for how to write a check.

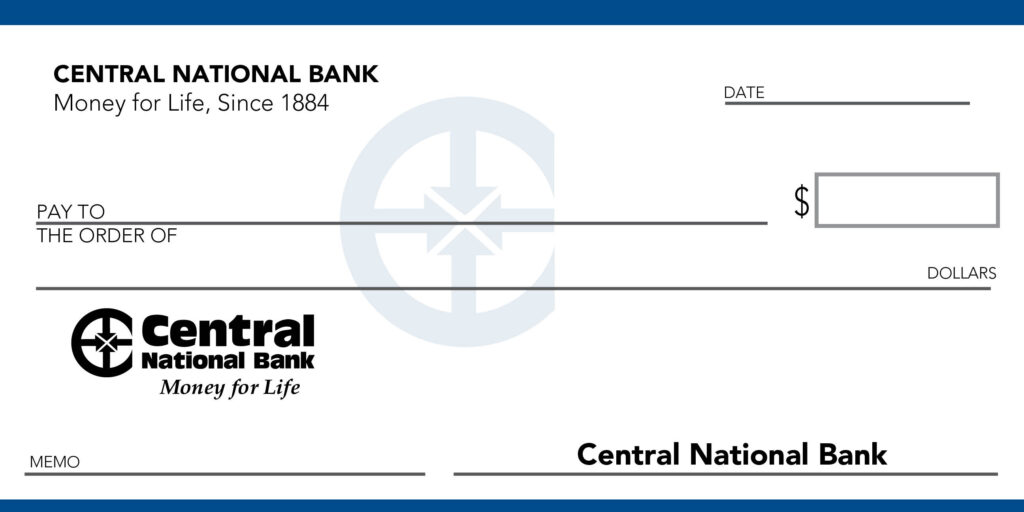

To start with, here is an image of a blank check.

You’ll notice it has ‘VOID’ on it. Anytime you give a blank check to a company to set up a payment, or give a check to your employer to set up direct deposits, it’s a good practice to write void across the check. If you ever make a mistake of any kind you should also write void on it and then shred the check to prevent it from falling into the wrong hands.

Now that we know how to safeguard your information below we will walk you through all components that make up your check.

Date

The date is an interesting component of a check. You want to date the check for the day you actually fill it out. So if you were writing this check to John for his birthday, you wouldn’t put his birthday on it, you’d put today’s date. If you have a carbon copy of the check that will help you keep record of when it was written.

The date on the check is also important because most, if not all, financial institutions will not accept a check written over 6 months ago. Some may have policies that say otherwise, but 6 months seems to be the point where most institutions draw the line. This prevents someone from cashing an old check and causing reconciliation problems for who it is drawn on.

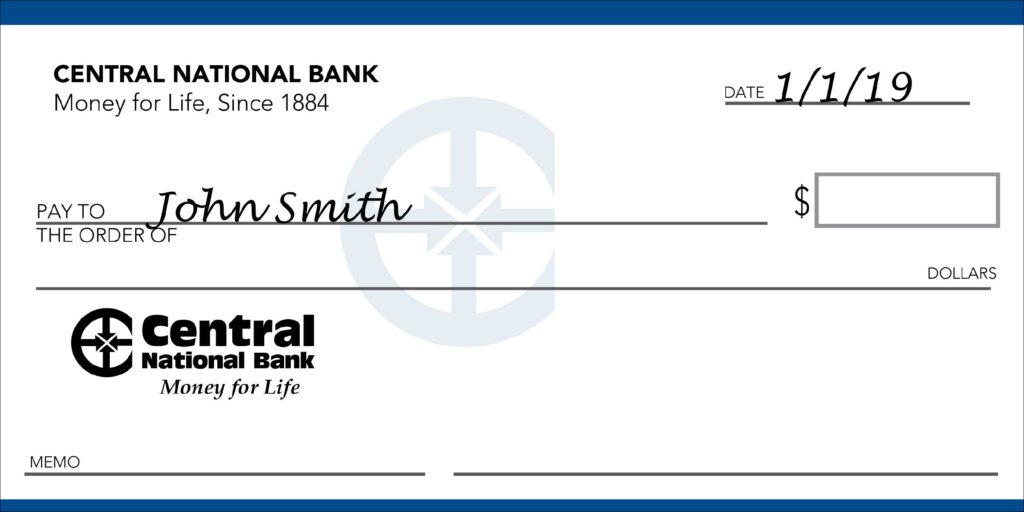

Pay to the order of

When you write a check, this is where you indicate to whom you are writing the check. The person who the check is intended for may also be referred to as the payee. The payee in this instance would be John Smith. His name and the date have been written in the proper spaces on the check below.

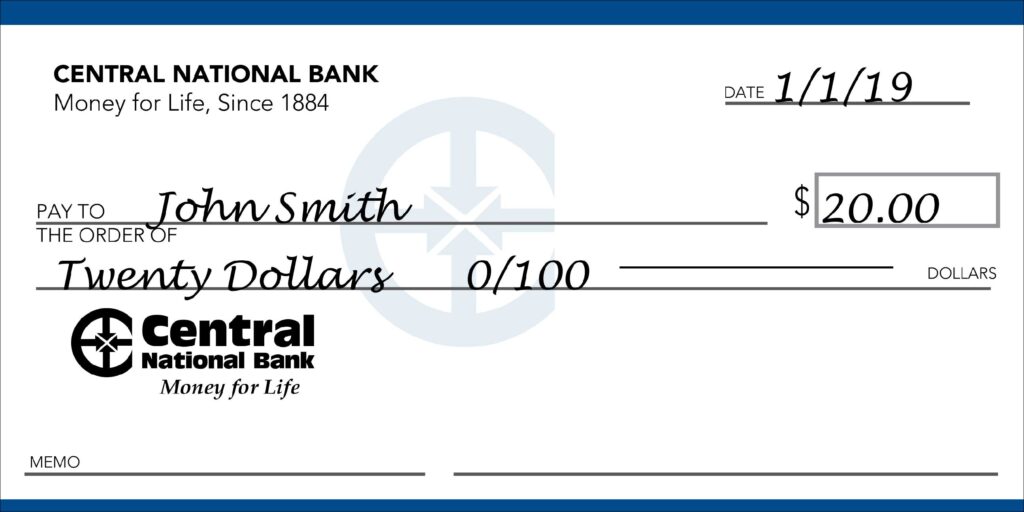

Entering the Amount

There are two places you will input the dollar amount. One is in numerical form and the other is written out. The square on the right side of the check is where the numerical amount will go. The written amount will go on the line directly below where you just put John’s name. You will often see a fraction on a check after the written amount. This is indicating the change amount of your payment. Since we’re giving John $20.00, it is 0/100, but if we were giving John $20.05 it would be 5/100.

Memo

The memo line in the bottom left is for inputting a memo about the check’s purpose. Sometimes it’s blank. If we we’re giving John a gift, we’ll put gift, or if it’s a payment for the job he did painting your living room, then you’d put ‘paint living room.’

Signature

The final part of the check is to sign it yourself. Once you’re certain that the check has the correct details, sign the check. Your signature is on the check it is final. Once you sign it, you have agreed to pay the check.

Once the check is signed and in possession of someone else, the only way to stop a check from being paid is to put a stop payment on it. At nearly every financial institution, there is a fee assessed to stop a check. Let’s say John misplaced your check and doesn’t know where it went. A stop payment can be used then to offer you security and peace of mind.

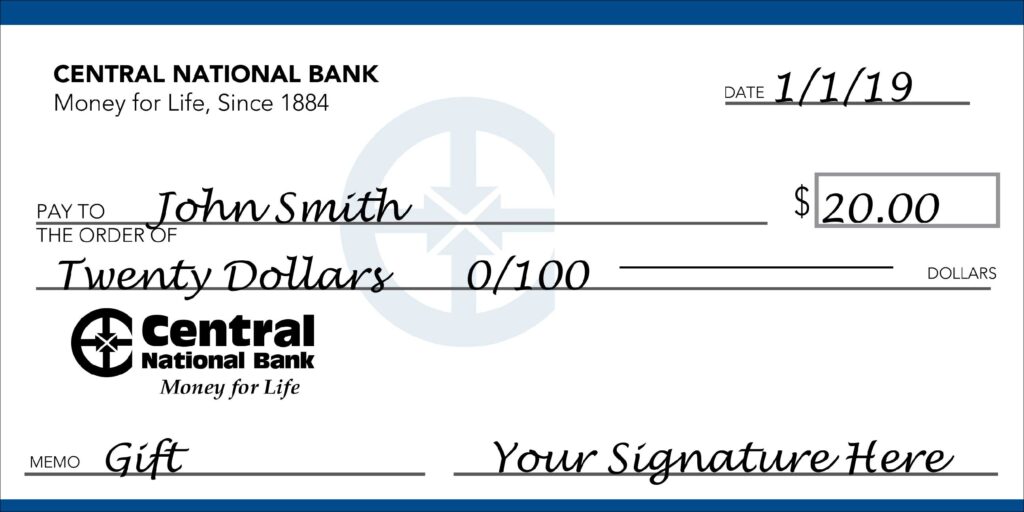

Here is an example of the finished product: