New year, new you. Right? It you’ve been lacking motivation to start saving, or have fallen behind on your financial goals, now is a great time to turn over a new leaf and start fresh. No matter what your goals are, whether it’s buying a house, retiring early or saving for a vacation, budgeting can help you get there.

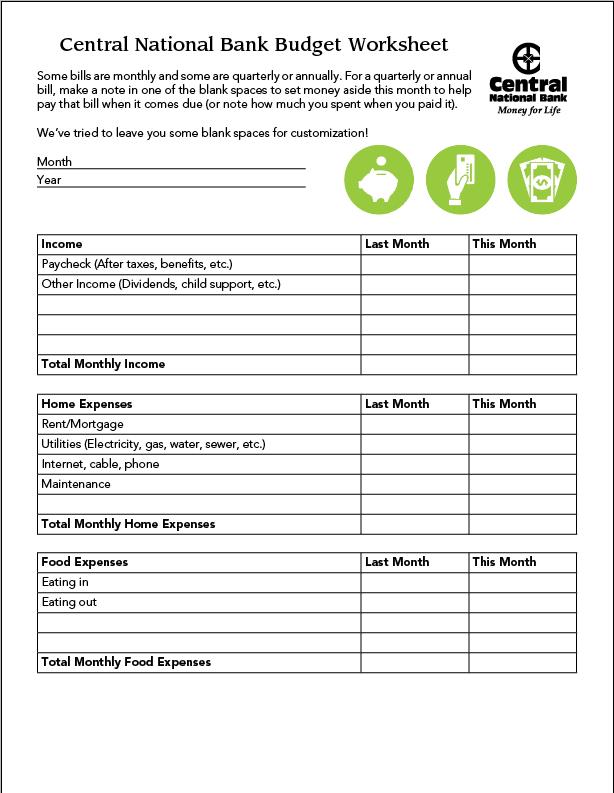

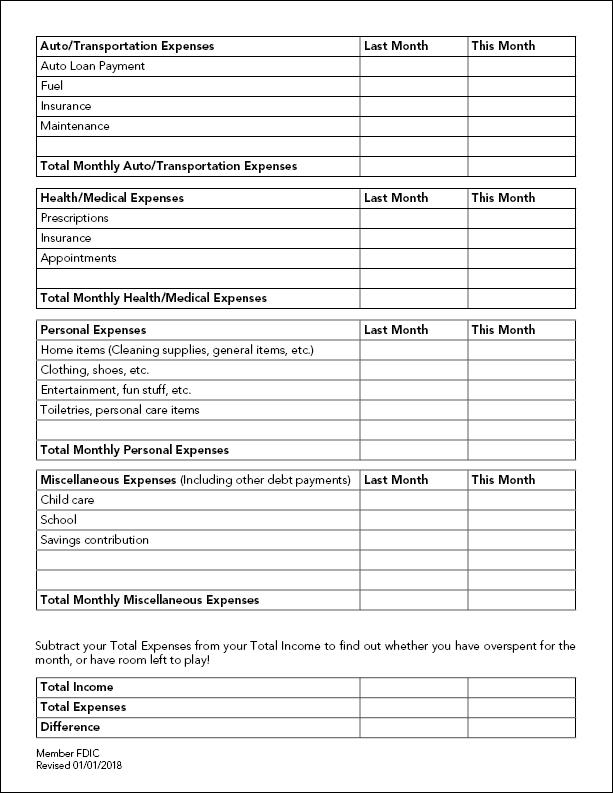

To help you get started with the budgeting process, we’ve created a customizable budgeting spreadsheet. Make it yours by adding or editing fields and keep the following tips in mind to help you turn your spending, and financial situation, around. To download your own copy of our Central National Bank Budget Worksheet, simply click the link.

To help you get started with the budgeting process, we’ve created a customizable budgeting spreadsheet. Make it yours by adding or editing fields and keep the following tips in mind to help you turn your spending, and financial situation, around. To download your own copy of our Central National Bank Budget Worksheet, simply click the link.

Tip #1: Start Small

A lot of people find budgeting overwhelming; which usually results in giving up or, in some cases, not starting in the first place. If you’ve made getting your finances in order a New Year’s resolution, you’re already halfway there! Don’t let budgeting become a long, unpleasant chore. Break the process up into more attainable chunks. If you’ve never used a budgeting spreadsheet as a tool before, start by filling in one category, like “Home Expenses.” This way, you’ll know how much you’re spending on rent, utilities and maintenance; and you can get used to the idea of tracking these expenses on a monthly basis. As you become more comfortable budgeting, fill in some of the other categories to get a more complete picture of your finances. Remember, it’s better to start small and grow, than to try and do it all at once.

Tip #2: Start a schedule

Research and studies have shown that it takes around 66 days for something to become a habit (read more about it on this article, “How Long Does it Take for Something to Become a Habit?“) That’s a little over two months. If you want budgeting to become a life-long habit, and not just a brief resolution, you need to be practicing it regularly. The easiest way to do this is to schedule budgeting into your calendar. Make a date with yourself. Whether you’re able to commit to something weekly or monthly, create a standing appointment where you know you’ll be able to put in some quality time focusing on your budget and finances. Budget a few dollars to treat yourself to a cup of coffee from your favorite coffee shop. Anything to help make this routine more pleasant, and motivate you to follow it, will help you achieve your goals.

Tip #3: Start some goals

Budgeting can be hard work. When you first start out, you may be budgeting with the idea in mind, “I want to improve my finances.” This is a great place to start. However, setting more specific goals, that are actionable, can help you have something to strive towards. Your goals will, of course, depend on your specific and unique situation. An example of a good goal is, “I want to save at least $1,000 every month.” Of course, fill in your own dollar amount, but with a specific goal you will know whether you reached it, or not. And then, if you missed your goal, you can explore opportunities to cut back and reach the goal next month. If you do make your goal, don’t forget to celebrate! Acknowledge that you’ve made great progress, and that you’re on the right track. This will help you stay motivated so you continue to set and reach new goals.