If you’ve ever read a financial advice article or watched the financial segment of the news and been confused, you’re not alone. Banks, investors and the stock market are full of jargon that the average person might not necessarily know or fully understand.

In honor of Dictionary Day, we’ve compiled and briefly explained a list of some financially-related terms from A – Z. You might be familiar with some, while others are not-so-common and a few might even clear up some misconceptions. Being financially literate is the foundation for making smart monetary decisions, so we hope our short dictionary of terms helps you get started or improve on your current knowledge!

Click “Read More” for a full list of terms (and some bonus graphics).

Read more

Bear/bull market: These terms are used to describe investing and the stock market. If there’s a bull market, everything is moving forward (like a bull), and investors are feeling optimistic. If there is a bear market however, investors are pulling back (like a bear hibernating) and are feeling more pessimistic.

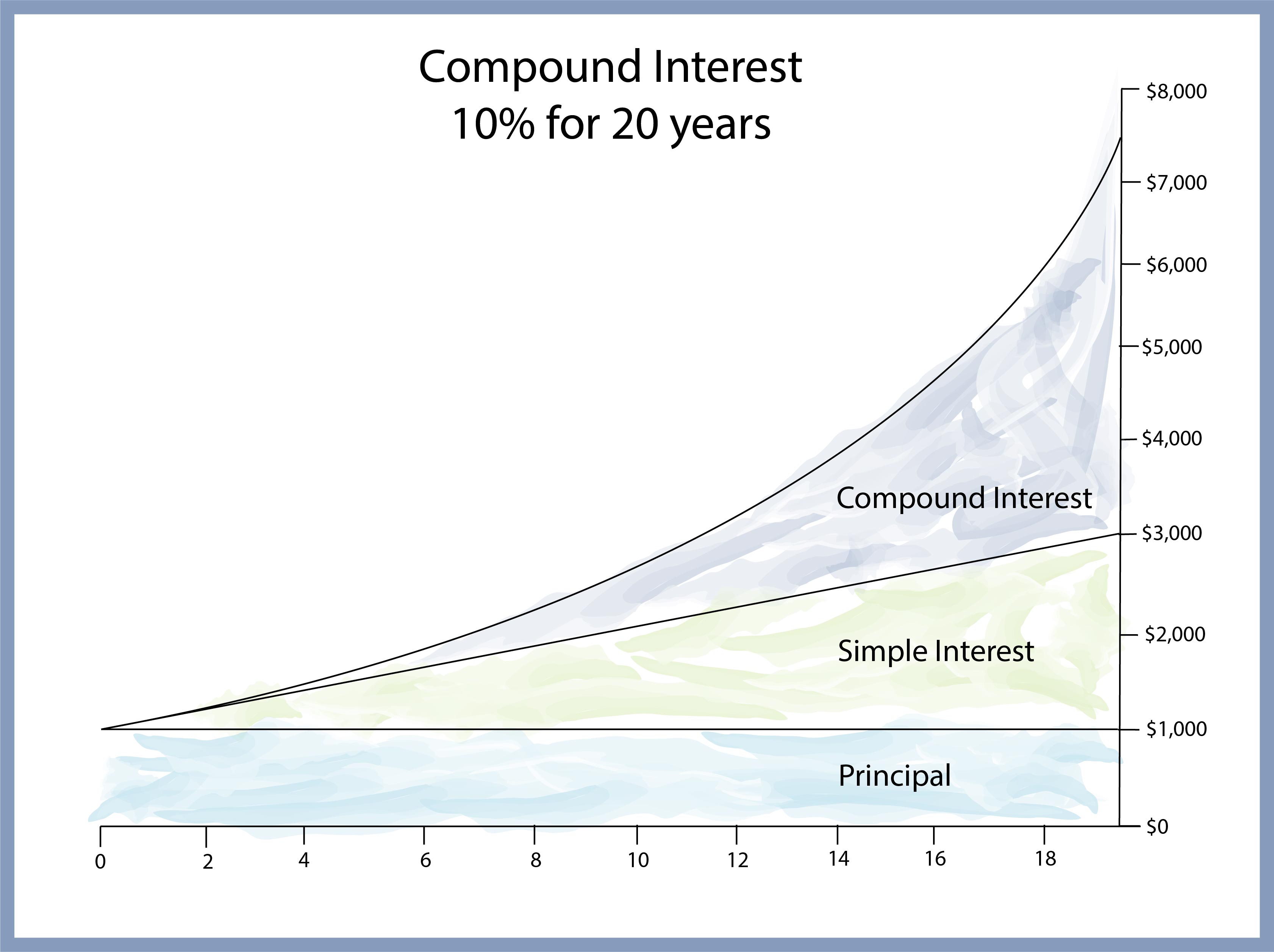

Compound interest: While this might seem like a simple idea, understanding compound interest is vitally important when it comes to saving and getting ahead. The younger you start, the better. Why? Because compound interest accumulates and grows each year due to the previous year’s interest. In contrast, simple interest is always based off the principal amount alone. Keep in mind that this works both ways. Not only can it help you save vast amounts, it can cause you to quickly be buried under a mountain of debt.

Diversification: This is the process of investing your money in different areas to reduce risk. Instead of investing all in one company, you spread it out among lots of companies. Instead of buying only US stocks, you purchase both US and foreign ones. This way, if one company goes bankrupt or a particular market crashes, you won’t lose everything.

Equity: When buying a home, very few people can afford to purchase their house outright. Instead, they take out a mortgage to pay off their property over time. Equity equals the worth of your house minus what you owe on it. When you make a down payment, this becomes equity. As you continue to make mortgage payments, this adds to your equity, which can become a great asset.

FDIC: If you’ve ever been to a bank, you’ve probably seen the term FDIC somewhere. But what does it actually mean? The Federal Deposit Insurance Corporation insures deposits against bank failure. This means if you open an account at any FDIC insured bank, they purchase insurance on your accounts on your behalf. If that bank goes under, either a new bank will immediately take over, or the FDIC will liquidate everything and give you a payout for your accounts up to $250,000 per depositor, per insured bank, for each ownership category. The FDIC insures checking accounts, savings accounts, money market accounts, CDs, and cashier’s checks; but it’s a good idea to check with the FDIC if you have coverage questions at https://www5.fdic.gov/edie/

Guarantor: A guarantor is someone who guarantees to pay for someone else’s debt if they default on a loan or other obligation. Essentially, they are a co-signer. For instance, if a college student wished to purchase a car, they would most likely require someone with more established assets to act as a guarantor on their loan. It is typical for those with a limiting credit factor to need a guarantor in order to receive a loan.

Hard inquiry: A hard inquiry is a credit report check that can possibly lower your score. This occurs when someone applies for any type of credit, such as a mortgage or auto loan. Someone who is applying for new credit is considered potentially riskier, thus the lowered score. However, credit checks that are for informational purposes only, such as checking your own report, are categorized as soft inquiries and do not affect your credit score.

Inflation: This is the rise in price of goods and services over a period of time, also known as a decrease in purchasing power of a currency. This is important to keep in mind as you plan for retirement. Due to the effects of inflation, your saving target for the future will have to increase to pay for the same standard of living that you have today. In order to be prepared and take inflation into account, you should save more for retirement than you think you will need.

Joint account with rights of survivorship: This is a bank account that two or more individuals share and have access to. All parties have access to funds, so it’s typically used by relatives or couples that have a high level of trust between them. Joint accounts can be temporary or permanent. If one of the account holders dies, the remaining holders will have complete and sole access to the funds (or debts) associated with the account.

Keogh plan: You’ve heard of the 401(k), but you might not have heard of the Keogh. This retirement plan is also known as an HR 10 or qualified plan and is designed for self-employed people or very small businesses. This is a very specific retirement plan that is used rarely, as other options often make more sense for someone’s situation. Someone who might wish to use a Keogh would be a highly paid, self-employed professional, such as a private-practice dentist or lawyer.

Liquidity: Liquidity is the ease with which assets can be converted into cash. If something is liquid, it’s easily bought and sold. For instance, checking and savings account funds are considered very liquid because you can easily withdraw anytime you like. On the opposite end, an asset is illiquid if it is difficult to buy and sell. A house is a good example of an illiquid asset because it takes a considerable amount of time and resources to sell one.

Mutual fund: If you’re completely new to investing, a mutual fund might be less daunting than some other options to start out with. A mutual fund is a collection of stocks, bonds and other assets and is managed by an investment company. Your money is pooled with other investors’ money, and then the company buys and trades assets according to the fund’s goals. Mutual funds are something beginners should consider because you’re able to buy shares in hundreds of different companies without having to personally monitor all your investments yourself. However, there are management fees involved.

Net worth: To gain a big-picture understanding of your personal finances, net worth is a great thing to calculate. It’s simply assets minus liabilities. Assets might include the value of your home, property, savings accounts and investments. Liabilities are debts (loans, mortgages, etc). Knowing your net worth is a good way to gauge how financially sound you are. By comparing your net worth over time, you can gain an understanding of the impact your financial decisions have.

Overdraft: Say you write a check for $500, but you only have $400 in your bank account. Rather than letting your check bounce, the bank lets this check go through. This creates an overdraft. It is essentially borrowing money from your bank once your account reaches zero. Like any other loan, there is a cost for this service. While paying an overdraft fee can be worth it if you’re in a pinch, it’s not something you want to get in the habit of using.

Prime rate: Prime refers to a popular index that banks often use to determine loan rate. The better your credit score, the closer you are to being offered a loan “at prime” or below prime. If you’re offered a rate that is “prime plus a percentage,” that extra percentage is a direct result of the calculation of your risk which is based off your credit score, income, etc. If you’re shopping around for a loan, look for one that’s as close to prime as possible.

Quarterly: If you hear someone talking about their earnings in such-and-such quarter, they’re talking about a certain period of time in the financial calendar. Each quarter is three months long, or a fourth of the year. The quarters are written as Q1 – Q4 and serve as benchmarks for financial comparisons. If you’re looking to track your financial progress with a higher degree of specificity than on an annual basis, quarterly reports might be the way to go.

Rebate: A lot of people take advantage of coupons, but far fewer use rebates. A rebate is the return of a portion of a purchase price that is given after the full amount is paid. So rather than receive 10 percent off your new phone, you pay full price, send in the necessary paperwork to the company and receive 10 percent back later. However, many people forget to send in for a rebate or just don’t have the motivation to do so.

S&P: The Standard & Poor’s 500 (S&P) is a stock market index based on 500 companies. It is used as a performance indicator for all other big companies (those with a market capitalization value of at least $10 billion) which is then used to provide a quick look at the overall stock market and economy. You’ve probably heard of the Dow Jones Industrial average, which is popular in the media and public, but financial professionals tend to use the S&P 500 instead. Knowing the basics of what it is and how it works can help you understand what the professionals are talking about.

Tax-deferred: If something is tax-deferred, you get to delay paying taxes on your income until later. A good example of this is a traditional IRA. The money you set aside for retirement is not taxed. Instead, you pay taxes when you withdraw that money. This is the opposite of a Roth IRA, where you pay taxes on your income before you invest it instead of when you withdraw. Both have their own advantages, so do some research to determine which you might want to use and how.

Unearned income: Any money that you make that comes from sources other than your employment is considered unearned income. For example, income that comes from investments, interest from a savings account or stock dividends are all considered unearned. This is important to know because unearned income is not subject to employment taxes such as Medicare and Social Security.

Venture capital: If you were to invest in a startup company, this financing would be considered venture capital. This is capital invested in a project where a substantial amount of risk is involved. So why would anyone want to put up such capital? For some, there are potentially higher-than-usual returns. Another benefit is that investors receive equity in the company in return for their financial help and so often have a say in company decisions.

W-4 Form: If you’ve ever had a job, you’ve had to fill out a W-4 form, or an Employee’s Withholding Allowance Certificate, to let your employer know your tax situation. Part of this form is a worksheet which allows you to calculate how many allowances to receive, which an employer then uses to calculate how much to withhold. If the employer withholds too much, you can receive a return when you file taxes, but if they withhold too little, you’ll actually owe the IRS that money.

Xenocurrency: This is currency that is used in markets outside of its original borders. For instance, if the euro is traded in the United States, it is then xenocurrency. However, most people in the financial world simply use the term “foreign currency” instead when referring to non-domestic money. This is thought to be because the word “xeno” can have somewhat negative connotations (for instance, the word xenophobia, which means fear of foreigners).

Yield: The yield of an investment is the annual income earned from it and is given as a percentage of the money invested. A yield is prospective and is taken by looking at a certain period of time and assuming the dividends and interests will continue at the same rate for a year. This is similar, but not the same as a return. While yield is the percentage increase on investments, return is an absolute dollar amount and is calculated in retrospect, by looking at what was earned in the past.

Zero-liability policy: This rule means that you are guaranteed to not be held responsible for unauthorized charges made with your account through fraudulent debit or credit card use. If someone steals your cards and runs up $5,000 in charges, you won’t have to pay that. Make sure when finding a bank or credit card that they offer zero-liability. Some policies cover some, but not all fraudulent activity, so make sure to read the fine print.