With the national student loan debt continuing to rise, the importance of saving for college has grown considerably. Since September is college savings month, we decided it may be a good time to remind everyone about 529 college savings plans. What is a 529 plan? And what can, and can’t, it pay for?

What is a 529 plan?

A 529 plan is an investment account where the funds can be used to pay for education-related expenses. Contributions can be made by the beneficiary (the student), parents, grandparents, friends and extended family. Most people immediately associate a 529 plan with college, but it can be used for any form of education, this includes elementary and secondary schools (certain limits may apply).

A 529 plan can be used for…

529 plans are not limited to traditional college tuition. It can also be used to pay for trade schools, vocational schools, community college, theological seminars, international schools and study abroad programs sponsored by U.S. schools.

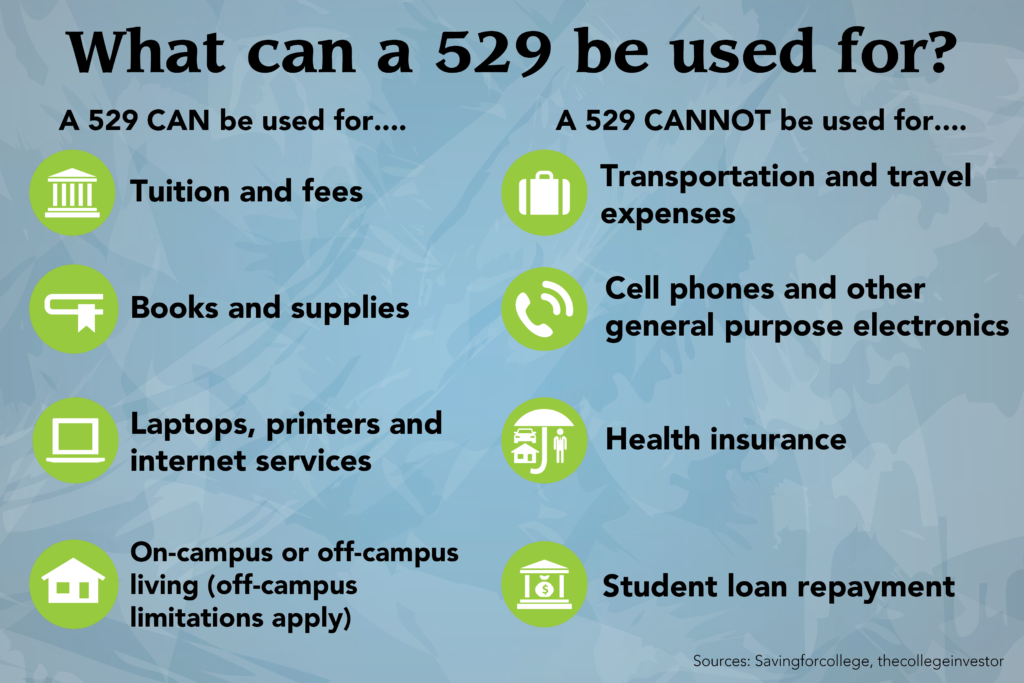

In addition to tuition, a 529 plan can also help pay for any supplies needed for classes. This includes books, access codes, pens, pencils and any lab supplies you have to purchase. Supplies are not limited to items like pen and paper either. Electronics necessary to complete school work including a laptop, internet services and printers also qualify.

A 529 can be used to pay for off-campus housing up to the amount of what it costs to live on campus. So if your apartment rent is more than the cost to live on campus, it is up to you to make up the difference.

A 529 plan cannot be used for….

There are a few things you may associate with school that don’t qualify as an expense that can be paid with a 529 plan. The first item would be a cell phone. While it is a great means of communication, it is not an expense that is deemed a necessity for school. You can access email via your laptop, so the cell phone didn’t make the cut.

If you live off campus, or are going to a school far from home, travel and transportation expenses also do not qualify. An example of these expenses would be gas to commute to campus, or a plane ticket to go home for the holidays. In addition to cell phones and transportation, health insurance is another expense that does not qualify under a 529 plan.

The last expense to think about is loan repayment. There are ways to use excess funds in a 529 plan to pay off student loans, but they would be subject to taxation or other fees. If you have money remaining in a 529 plan upon graduation, it would be a good idea to consult a financial advisor before deciding what to do with the remaining funds.

The Benefits

To go along with the purchases that qualify, there are a few other benefits to having a 529 plan. Accounts grow tax deferred and distributions, or withdrawals, for qualified education-related expenses are generally tax-free. And unlike other college savings plans, 529 plans allow you to remain as the account owner regardless of the beneficiary’s age. It may also be worth mentioning that some states allow for tax deductibility at the state level for 529 plans. Kansas, Nebraska and Missouri are all states that offer a tax deduction for 529 plans, but each state has a different set of limits that you will want to discuss with your tax advisor.

Central National Bank has a team of financial advisors ready to work with you and answer any questions you may have. If there is something we didn’t discuss that you have questions about, reach out to one of our financial advisors to learn more. You can find contact information for our team on our website at https://centralnational.com/whycentral/meetus.asp#trustofficers.