Merchants, it seems that there’s a new and potentially virulent malware that makes its way out into the world every week. Many of these malware use technologies to bypass anti-virus software to capture credit card data. We think it’s important that you know

Beat Summer Boredom

Do you Have a Home Inventory?

Top 3 Reasons to Open a Checking Account with Rewards!

Memorial Day Recipes

Older Americans Month- Help Seniors Protect Against Online Fraud.

Needing A New Ride?

Why You Should Consider a Home Equity Line Of Credit

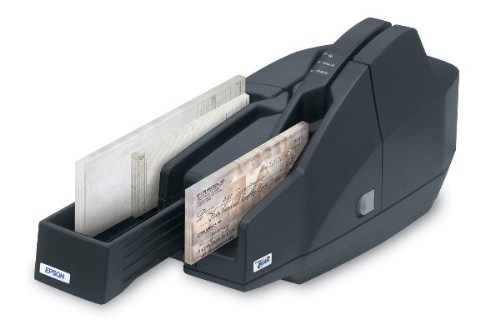

Bring The Bank To Your Business

Make Paying Your Friends Back Easier